when are property taxes due in illinois 2019

See how your individual property taxes are distributed for any parcel and how to contact those taxing bodies on Lake Countys Tax Distribution website. Illinois is extending the 2019 tax year filing and payment due date for C corporations who file Form IL-1120 from April 15 2020 to July 15 2020.

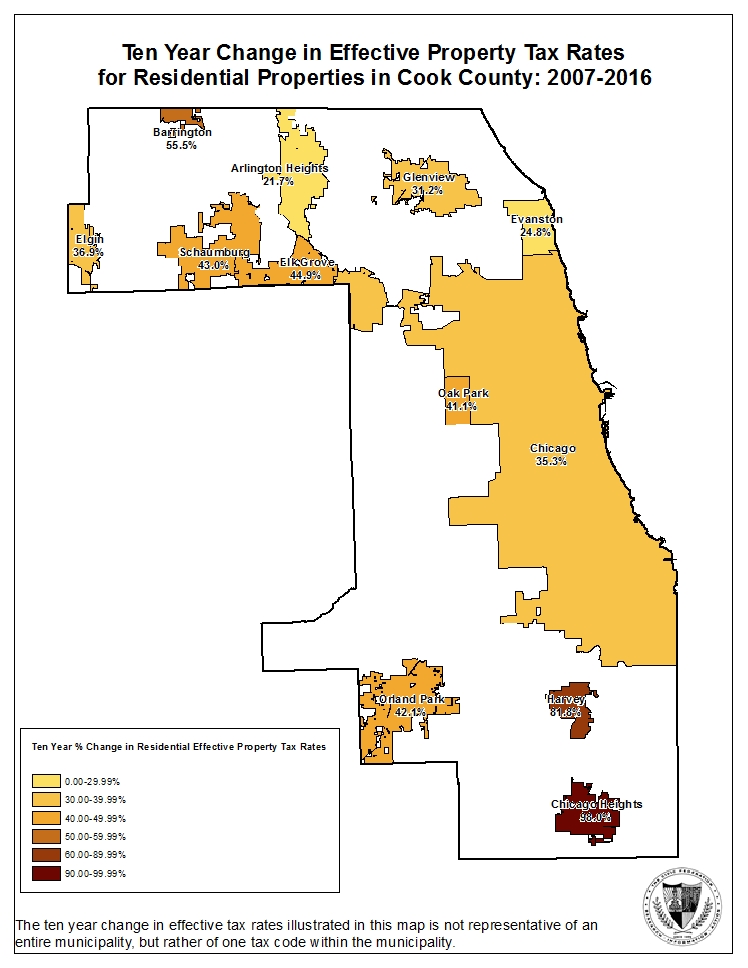

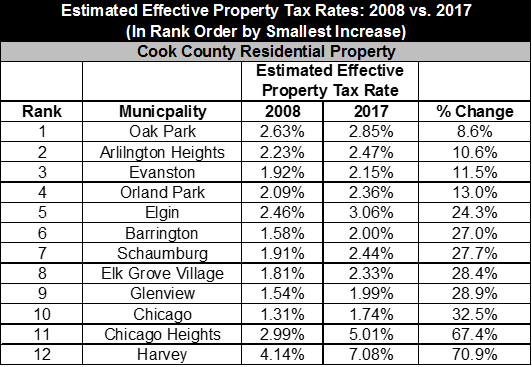

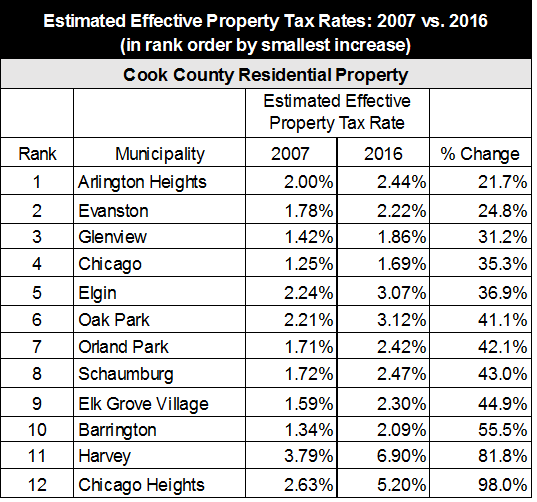

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

The 2020 tax bills payable in 2021 were mailed Friday May 7 2021.

. Tax Year 2020 First Installment Due Date. This page is your source for all of your property tax questions. Last day to submit changes for ACH withdrawals for the 1st installment.

15 penalty interest added per State Statute. Box 1216 Rockford IL 61105-1216. Duties and Responsibilities of the Cook County Treasurer.

The Property Tax System. Tuesday March 1 2022. Illinois created a new new property tax relief task force in 2019.

A United States Postal Service postmark is accepted as date of payment in the calculation of a late penalty. 090722 Sub-tax may be paid by tax buyer between 900 am. 1st installment due date.

2019 Final Taxing Body Distribution Report as of 11-20-20. Maria Pappas Cook County Treasurers Biography. The Online Property Inquiry tool updates every hour to reflect the most recent payments.

Joe Sosnowski R-Rockford filed House Bill 5772 which calls for a 90-day delay without penalties on 2019 property tax payments which come due. Residents wanting information about anything related to property taxes or fees paid to the county can click through the links in this section. In most counties property taxes are paid in two installments usually June 1 and September 1.

Payment can be made by. Friday October 1 2021. View 2021 Taxes payable in 2022 View 2020 Taxes payable in 2021.

45 penalty interest added per State Statute. Martin Luther King Jrs birthday. This report conducted jointly by researchers at the Illinois Economic Policy Institute ILEPI and the Project for Middle Class Renewal PMCR at the University of Illinois at Urbana-Champaign investigates property taxes in Illinois.

Welcome to Property Taxes and Fees. Property tax bills mailed. Due dates are June 7 and September 7 2021.

Illinois is not extending the filing or payment due dates for tax year 2019 returns for partnerships including nonresident withholding Form IL-1065 which still falls on April 15 2020. Illinois has one of the highest average property tax rates in the country with only six states levying higher property taxes. To avoid any late penalty the payment must be made on or before due date.

2020 Final Taxing Bodgy Distribution Report as of 11-18-21. January 1 2020 - New Years Day. Tuesday March 2 2021 Late Payment Interest Waived through Monday May 3 2021 Tax Sales 2022 Scavenger Sale.

The Cook County Property Tax Portal is the result of collaboration among the elected officials who take part in the property tax system. If you are a taxpayer and would like more information or forms please contact your local county officials. View maps of different taxing districts in Lake Countys Tax District Map Gallery.

If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill. Tax Year 2021 First Installment Due Date. Annual How Your Property Taxes Compare Based on an Assessed Home Value of 250000.

Online payments will be available again starting approximately May 31 2020 and ending November 27 2020 at 400 pm. Clicking on the links with this symbol will take you to a county office or related office with its own website while the links without the symbol belongs to a. 23 rows 2020 Estimated Income Tax Payments for Individuals Use this form for payments.

Due dates will be as follows. Macon County Property Tax Information. The Senior Citizen Real Estate Tax Deferral Program.

Property TaxesMonday - Friday 830 - 430. Duplicate bills are available on-line. 3 penalty interest added per State Statute.

Tax Year 2020 Second Installment Due Date. Appeals are accepted and decisions reached on changes to a propertys assessment classification or exemptions. How to Pay Your Tax Bill.

Monday February 14 through Tuesday March 2 2022 2019 Annual Sale. 2018 Tax Bill Listing by Township. January 20 2020 - Dr.

State of the Office. Mail your tax bill and payment to. Goral Winnebago County Treasurer PO.

But if going to deed 3rd year of non-payment tax buyer may pay tax amount on May 13th. 090522 LABOR DAY - OFFICE CLOSED. 2100 of Assessed Home Value.

1 st Installment due June 1 2022 with the interest to begin accruing June 2 2022 at 15 per month post-mark accepted. 2160 of Assessed Home Value. Maria Pappas Cook County Treasurers Resume.

Property tax due dates for 2019 taxes payable in 2020. Learn how the County Board has kept the tax levy flat for Fiscal Years 2020 and 2021. Pay tax bills online.

The Assessor assesses all real estate located throughout the County and establishes a fair market value for each property. Welcome to Madison County Illinois. Freedom of Information Requests.

090222 Per Illinois State Statute 1½ interest per month due on late payments. 2 nd Installment due September 1 2022 with the interest to begin accruing September 2 2022 at 15 per month post-mark accepted. 2018 Final Taxing Body Distribution Report as of 11192019.

There are many offices that hold different pieces of information about your property tax and this page is intended to get you to the answer with as few clicks as possible. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. Online Payments Online payments are only available during a portion of the tax collection period.

Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. What months are property taxes due in Illinois. American Express Visa MasterCard and Discover credit cards see Convenience Fee Schedule below An added fee.

It is managed by the local governments including cities counties and taxing districts. The Illinois Department of Revenue does not administer property tax. 090122 2nd installment due date.

The Portal consolidates information and delivers Cook County taxpayers a one-stop customer service website.

Property Tax Village Of Carol Stream Il

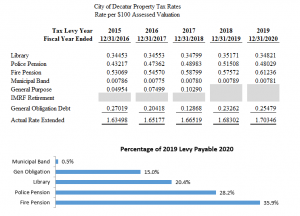

Property Tax City Of Decatur Il

Illinois Income Tax Rate And Brackets 2019

The Cook County Property Tax System Cook County Assessor S Office

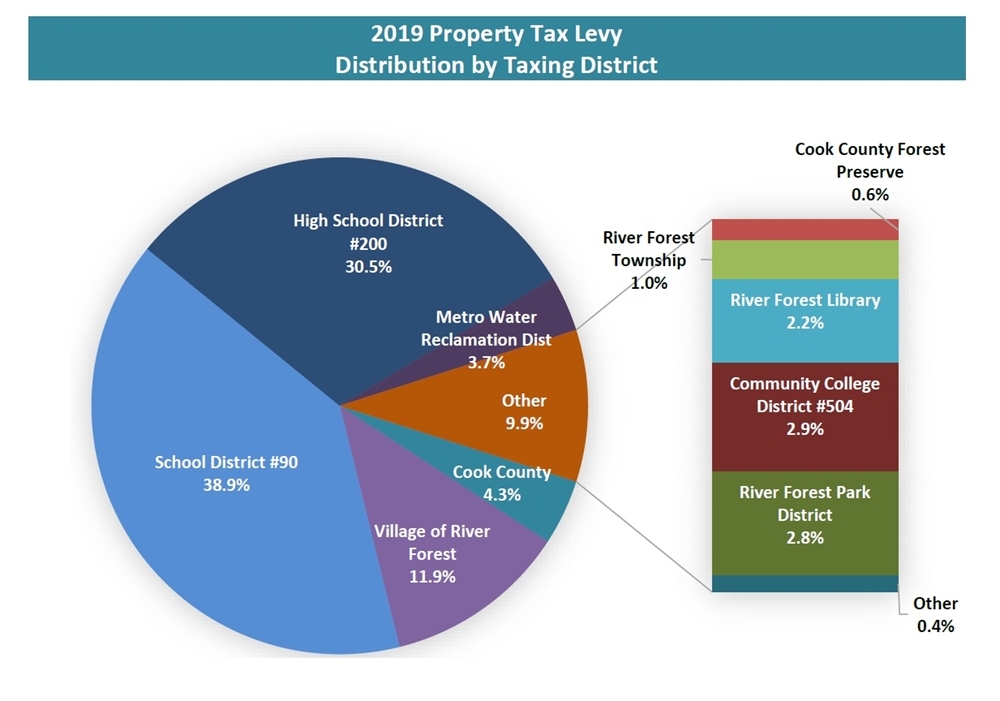

Tax Information Village Of River Forest

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Illinois Taxes Illinois Economic Policy Institute Illinois Economic Policy Institute

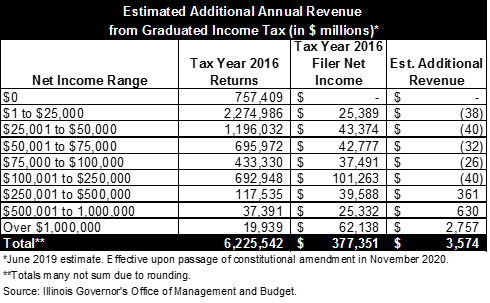

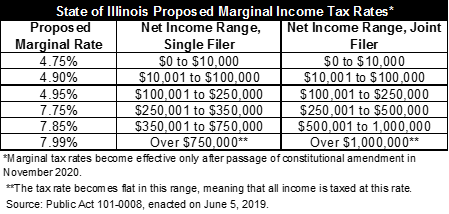

Graduated Income Tax Proposal Part Ii A Guide To The Illinois Plan The Civic Federation

Where S My Illinois State Tax Refund Il Tax Brackets Taxact

What S Being Done To Reduce High Property Taxes In Illinois Property Tax Estate Tax Illinois

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

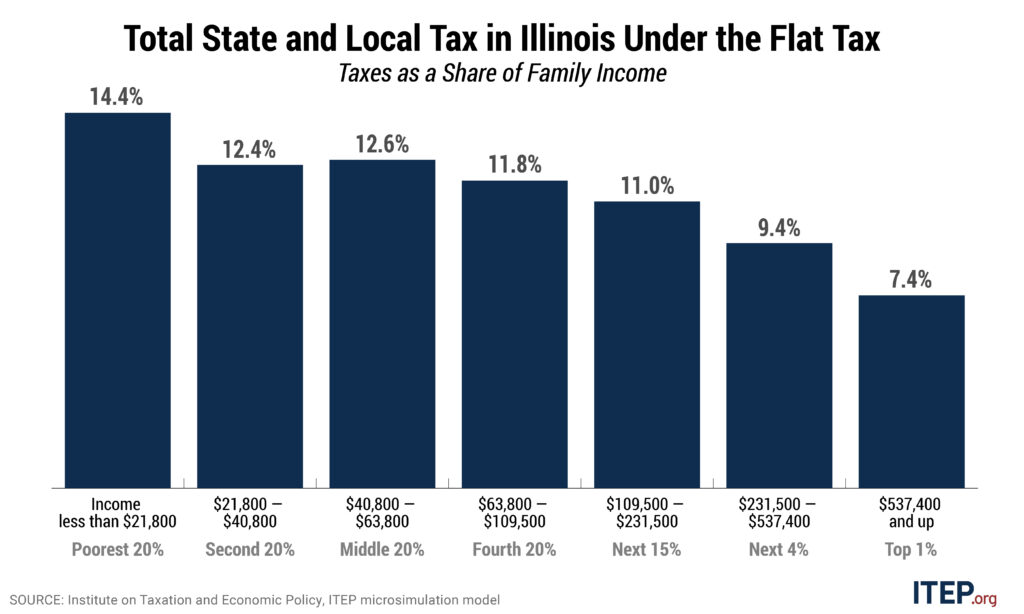

Illinois S Flat Tax Exacerbates Income Inequality And Racial Wealth Gaps Itep

The Cook County Property Tax System Cook County Assessor S Office

What Is The Illinois Estate Tax Rate Much Shelist P C

Growing Out Of Control Property Taxes Put Increasing Burden On Illinois Taxpayers Property Tax Tax Property

Graduated Income Tax Proposal Part Ii A Guide To The Illinois Plan The Civic Federation

Illinois Taxes Illinois Economic Policy Institute Illinois Economic Policy Institute